Welcome to Polymathic Being, a place to explore counterintuitive insights across multiple domains. These essays take common topics and investigate them from different perspectives and disciplines to come up with unique insights and solutions.

A note before we start:

Thank you to everyone who has subscribed, especially the new paid subscriptions. As I work to grow this community I’m constantly learning and adapting and, as such, you should expect to see continuous exploration to test interaction and content.

Speaking of interaction, what really helps is getting the word out by sharing these essays whether just sending the link to a friend, or posting on social media. This community grows through you and if you’ve enjoyed the topics, I’m sure someone else will as well!

Please subscribe if you haven’t already and, since we are in the season of giving, please consider either gifting or donating a subscription to friends and family.

Today's topic dives into cryptocurrency and blockchain, in general, to look at the positives and negatives of where these technologies can take us in the future. We’ll introduce blockchains, cryptocurrency, and blockchain analytics and then focus on what can happen when governments begin leveraging blockchains and some of the risks involved.

Introduction to Blockchain

A little baselining is probably necessary as we get into this topic. First off, we must separate cryptocurrency from the blockchain in general because they are different. The foundation of the crypto world is blockchains which are, as Investopedia defines:

A blockchain is a distributed database or ledger that is shared among the nodes of a computer network. As a database, a blockchain stores information electronically in digital format. Blockchains are best known for maintaining a secure and decentralized record of transactions. The innovation with a blockchain is that it guarantees the fidelity and security of a record of data and generates trust without the need for a trusted third party.

With the foundation of blockchain, we can then place different things in the ledger to transact. The clearest example of this is cryptocurrencies where Ether, the currency, is transacted on Ethereum, the blockchain, where mining Ether is what helps monetize and fuel the distributed network.

Where it gets messy is that a blockchain can not only host currency but a variety of other assets which start blending on the same blockchain. As the Motley Fool explains:

Tokens, on the other hand, have far more uses than just digital money. Tokens are created on top of an existing blockchain and can be used as part of a software application (like to grant access to an app, to verify identity, or to track products moving through a supply chain). They can represent digital art (like with NFTs, or "non-fungible tokens" that certify something as unique). There has even been experimentation using NFTs with physical assets, such as real-life art and real estate.

Blockchains and their associate networks are the foundation and the structure on which other assets can be transacted. This architecture also has the benefit of being pseudonymous (not directly attributable to you), immutable (can’t be forged), with global reach and rapid settlement (you don’t have to wait for the asset to ‘clear the bank’). It is a public ledger for transparency and is designed to be censorship resistant. A final benefit is decentralization, meaning no corporation or government needs to be involved.

Clearly, blockchains with their coins, tokens, and decentralized applications (DApps) have great potential to digitize much of our lives from currency to assets, to even art. These are the things that make blockchains so exciting and enticing to so many people!

Blockchain Analytics

With the explosion of cryptocurrencies across the financial markets, and for the reasons of pseudonymity, global reach, and rapid settlement, illicit actors began using crypto to extract revenue from cyber attacks, monetize child exploitation and human trafficking, and more. State and non-state actors are also using crypto as a method to bypass sanctions and anti-proliferation laws, obfuscate money laundering and anonymize cyber criminals. Fundamentally the same things these illicit actors had been doing previously but crypto currency gets the bad rap. I’ll add here that this criminal activity makes up a tiny percentage of crypto transactions and crypto is used for less illicit activity than fiat currencies still today!

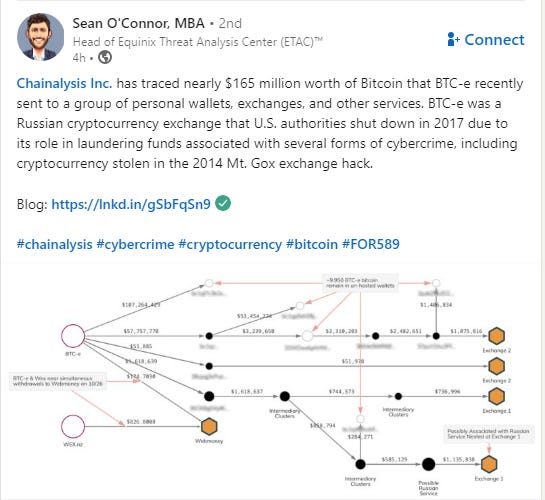

To combat illicit activity, specifically terrorism funding, the CIA, through their venture capital arm In-Q-Tel, invested in the creation of companies doing blockchain analytics. While you’ve always been able to look at a blockchain explorer and see the public ledger, typically one transaction at a time, it was difficult and time-consuming to trace complex transactions.

But crypto is pseudonymous, right? You can’t know who is transacting what!

Certainly, the original goal of Bitcoin and Ethereum architected anonymity as the foundation. But with Anti-Money Laundering (AML), the Travel Rule for transactions, and Know Your Customer (KYC) regulations, there are now identifiers on your crypto wallets that are known at key exchanges where you convert your fiat currency into crypto and back to fiat. Further, considering the public ledger patterns of life that can be extracted from your transactions using modest software tools, let alone the application of Artificial Intelligence and Machine Learning (AI/ML), means we’ve barely scratched the digital footprint crypto actually entails. Even obfuscation techniques like mixing (where people deposit crypto and, for a fee, it is mixed with other cryptos to mask the origination on withdrawal) are being reverse-engineered and mitigated.

With the investment in blockchain analytics firms and the application of big data tools, tracking becomes much easier and spawned a veritable arms race of cross-chain tracing, demixing, and other analytics to trace complex transactions along and among different blockchains. All of this effort provides much greater fidelity into the flow of assets than even our traditional systems.

Take for instance the example of the North Korean hacking group Lazarus in a 2018 malware attack on a cryptocurrency exchange where they stole $250 million and then moved it across the blockchain network and attempted to obfuscate through complex transaction, mixers, and even exchanging crypto for millions of dollars worth of Apple gift cards. Yet all these transactions are now visible and traceable in modern blockchain analytic software resulting in the identification and arrest of accomplices.

This ability to trace and track transactions has led to some spectacular benefits like taking down Child Exploitation Sites and tracing and mitigating cryptocurrency hacks, and the presentation I gave at the Military Operations Research Society symposium this past June on Demonetizing Cyber Crime; Tracing Funds through Blockchain Analytics. While this goal to eliminate illicit activity on the blockchains is commendable and necessary, the tools can go both ways and can be used to track and trace legitimate activity as well.

Governments and Blockchains

Spending time in the crypto world, specifically around technologies that do cryptocurrency tracing, tracking, and visualizing, it quickly becomes evident that these technologies open Pandora’s box for governments as the original decentralized nature and pseudonymity become more visible, traceable, and observable. This transparency is what recent financial regulations, transaction reporting (such as the recent $600 reporting threshold vs. the previous $10K), and other financial restrictions have been attempting to do for years in our fiat money system.

While the original blockchains and cryptocurrencies worked to decentralize and create anonymity, there is no reason to maintain this architecture if nation-states decide to roll out their blockchain-based cryptocurrency. They have no reason to create a blockchain with anonymity and many private blockchains, such as within shipping and logistics, are already built like this. Nation States also have no reason to decentralize it as they could use a centralized ledger to better manage much of the government oversight that already exists.

Consider this scenario: your crypto wallet could be issued along with your social security number (SSN) and birth certificate. Heck, with smart contracts why don’t we just make your cryptographic public key your SSN and have NFTs of your birth certificate, draft card, driver’s license, marriage license, educational degrees, professional certifications, etc.?

You could use this structure to dole out social security, disability, and retirement. You could even have a special address for food stamps that could be coded for only food purchases. Every transaction can be traced, incomes confirmed, assets consolidated, and histories documented. You could roll out smart contracts and unique tags to manage different types of transactions to measure revenue vs expenses, tax shelters like 401Ks, etc.

You could just do away with all current forms of tax collection, reporting, and remittance. Instead, they could just charge fees on transactions.

Income tax on the transfers in

Sales tax on the transfers out

Additional tax fees for city/state/municipal

Special taxes for things like gas,

You could even pull off your progressive, gradient tax structures. Yearly income less than one level, here’s your subsidy. Income greater than another level, here’s your new fee structure for income tax.

In some ways, this could make it much simpler. Home loans could have instant knowledge of income, assets, credit risk, and much more. You wouldn’t even have to file taxes anymore. There wouldn’t have to be audits. Even problems like graft, corruption, and bribes would be much harder to transact.

The Dark Side

The consequence is there’d be no more side jobs, no more unclaimed tips, and no more Craigslist or Facebook Marketplace exchanges using cash and ‘off the record’. Every dollar out and every dollar in can be counted, tracked, and yes, taxed.

You’d lose a ton of privacy. The government would now know, with much greater ease, your patterns of life like spending patterns, savings levels, and social groups you interact with in ways that today, are much more difficult to pull together. For example, if every Friday you go to a certain bar with a group of friends, and each of you cashes out at the same time, a pattern emerges on the blockchain of your group, location, time, etc. Now just extrapolate this to the larger implications.

When combined with other data scraping, like the CIA using smart devices to listen in on conversations, clear ethical considerations need to be analyzed holistically, not discretely. It’s these larger systems of systems implications where something that could be used to an advantage, like cryptocurrency either anonymously or government-sponsored, but when considered in the broader implications and then paired with other technologies, can lead to some serious problems.

If you think I sound like a worrier, just consider that already, governments are leveraging advanced tech to analyze for property improvements, such as France recently using AI to find swimming pools to ensure the owners were paying their proper taxes.

The worst mix of government and blockchain would be along the lines of how China is leveraging it into its social credit score. Add it all together and then apply a ranking system for how ‘good’ a citizen you are and I’m sure you can see the risks to personal freedom and the challenges of preventing authoritarian tyranny. If you think this is a bridge too far, there are already members of Congress in the US advocating for a centralized cryptocurrency to “compete with China.“ Something tells me I’d rather lose that competition given the dark side implications.

Conclusion

I’m naturally a cynical optimist. I think blockchain and crypto could revolutionize our world through financial, logistical, and even contractual innovation. The architecture provides a fantastic ability to reduce the need for third-party middlemen, and make daily life simpler, with less paperwork, and without needing massive institutions. It doesn’t have to turn dystopian, but history shows that power like this becomes tantalizing for those who seek control.

As such, very intentional and proactive initiative needs to be taken, even now, to clearly delineate clear boundaries that protect our freedoms. We just need to keep our heads up, keep our eyes on the uses, and keep nudging technologies toward a better life, not towards more control and less privacy.

So what do you think? Will blockchain be used to increase the power of governments or can we restrain it, allowing more individual freedom? Or am I even asking the right question?

Enjoyed this post? Hit the ❤️ button above or below because it helps more people discover Substacks like this one and that’s a great thing. Also please share here or in your network to help us grow.

Polymathic Being is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Looking for other great newsletters and blogs? Try The Sample

Every morning, The Sample sends you an article from a blog or newsletter that matches up with your interests. When you get one you like, you can subscribe to the writer with one click. Sign up here.

Also, if you have a newsletter you would like to promote, they offer a great service that gets your writing out there to a new audience.

I wish this essay could of expanded the ideological use of Blockchain in the form of voting, since in the mainstream, blockchain is cluttered through talks of transacting digital "money". Please hear me out (or give a care to read this)...

Bitcoin is considered immutable... Meaning, nobody can hack Bitcoin and make any changes. How does this solve a voting "issue"?

I live in the United States, and there's been accusations between political parties in previous elections of being "stolen" by adding "dead people" votes or fraudulent votes that should not have been counted. If the American people were informed to solve this issue to use the blockchain and switch the voting system to the blockchain, where its immutable, how could fraudulent votes can get passed through, if the votes will be verified on the blockchain by its citizen?

The real threat in blockchain is not only money, but a revolution to lead a nation through direct democracy. That's right! We don't need representatives to represent us! If you are an American reading this, when were you allowed to vote for social programs, help small businesses grow, grow the "middle" class, involve in international affairs (like war in Ukraine)? I believe a direct democracy needs to be amended where every citizen (speaking to Americans) participates in how our nation should run... By the people! For the people! If corporations had to buy the people's vote, think about how much money it would take to influence a large amount of votes to go their way? That's why having a representative democracy is a lot easier, since its only made up of 535 voting members, when it should of been in the millions (the entire nation)?

Think about the phone and internet infrastructure that we have, and lets not take it for granted! Anybody with a cellphone with internet access can send their votes ANYWHERE around the world! Think about it?! We can be thousands of miles away from our country and still participate where our votes will be immutable, thanks to... Yes! The blockchain.

Please counter this argument of the limitations of blockchain in democracy!

For those who are not Americans reading this post, your opinions, ideas, beliefs and your being matter too! Every human being are part of history. Its the population of people that defines a nation, not the political leaders!

> I’m naturally a cynical optimist

Love it!